Residential Real Estate in Ho Chi Minh City, Vietnam

I first traveled to Ho Chi Minh City, Vietnam in February of 2011. At the time, virtually all vehicles on the road were motorbikes, side walk space was limited, and most real estate was two to four story residential buildings with the first floor used as commercial space. Vietnam's nominal GDP was $116 billion ($1,300 per capita). Though poor, to a foreigner with experience living in China, Vietnam's Confucian work ethic was readily apparent. Everyone seemed to be constantly busy and moving fast.

Just last week, almost eight years later, I returned to HCMC and saw an enormous degree of change, cars, skyscrapers, branded clothing stores and Starbucks abound. According to the IMF's 2018 data, Vietnam's GDP grew to $241 billion (about $2,500 per capita) more than doubling since I last visited. Vietnam's skyline is very different from when I last visited with many tall buildings completed and many more under construction. The percent of the population classified as urbanized has increased from about 30% to 35%, meaning an additional 4.5 million people have moved from rural areas to cities.

Education and Labor

Vietnam's education system has proved to be highly effective resulting in near universal literacy. Additionally, Vietnamese students tend to perform well on standardized tests in math and science, exceeding the OECD average.

I heard throughout my trip that one of the few benefits of Vietnam's experience with socialism was that it resulted in a high level of female enfranchisement into the workforce. This results in a situation where Vietnam is effectively utilizing all of its top human capital, rather than only utilizing human capital that happens to be male.

Family Formation and Home Ownership

Vietnamese, like other East Asian cultures have a strong preference for home ownership. Currently, home ownership rates in Vietnam are above 90%. Given that incomes have been growing rapidly and both men and women work. Upon getting married, Vietnamese couples will have both the resources and desire to move out of their parents' home and buy their first apartment.

Vietnamese Real Estate Industry

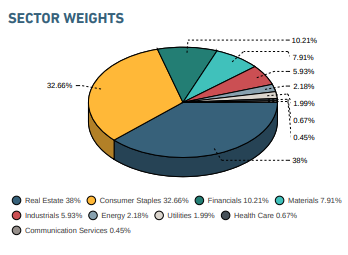

Entrepreneurs anticipating Vietnam's demographic and cultural preferences for new homes have formed real estate development companies. Both foreign and local real estate companies compete for land, development licenses, tenants and capital in Vietnam. One helpful heuristic that I’ve found to quickly understand the nature of a local economy is to look at the industry sector weights by market capitalization. The chart below indicates that 38% of Vietnam’s market capitalization came from the real estate industry.

MSCI Vietnam IMI, January 2019

Furthermore, two of the three largest public companies by market capitalization in Vietnam are in the residential real estate industry, Vinhomes and Vingroup. Both are controlled by the same entrepreneur, Pham Nhat Vuong, the richest person in Vietnam. Clearly residential housing demand is a big business opportunity for sophisticated real estate developers and institutional investors; but I wondered if it was possible for foreigners to buy property in Vietnam?

Buying a home in Vietnam on WeChat

I used WeChat to locate a real estate broker named Sarah Gui (WeChat: sarah7_722) who caters to Chinese people that are interested in buying property in Vietnam. During my conversation with Sarah we discussed regulation, taxation, where to buy in HCMC and what opportunities are currently available on the primary market.

Firstly, it is possible for foreigners to buy property. In 2015, the Vietnamese government clarified the law and set up a system to allow foreigners to legally purchase property. There are some important distinctions between the property rights of local Vietnamese and the property rights of foreigners.

Incidentally, I was told that the primary reason for preventing foreigners from levering their purchases is to reduce the risk of a housing bubble and to maintain home price affordability for local buyers who are much less capitalized.

HCMC Location Guide

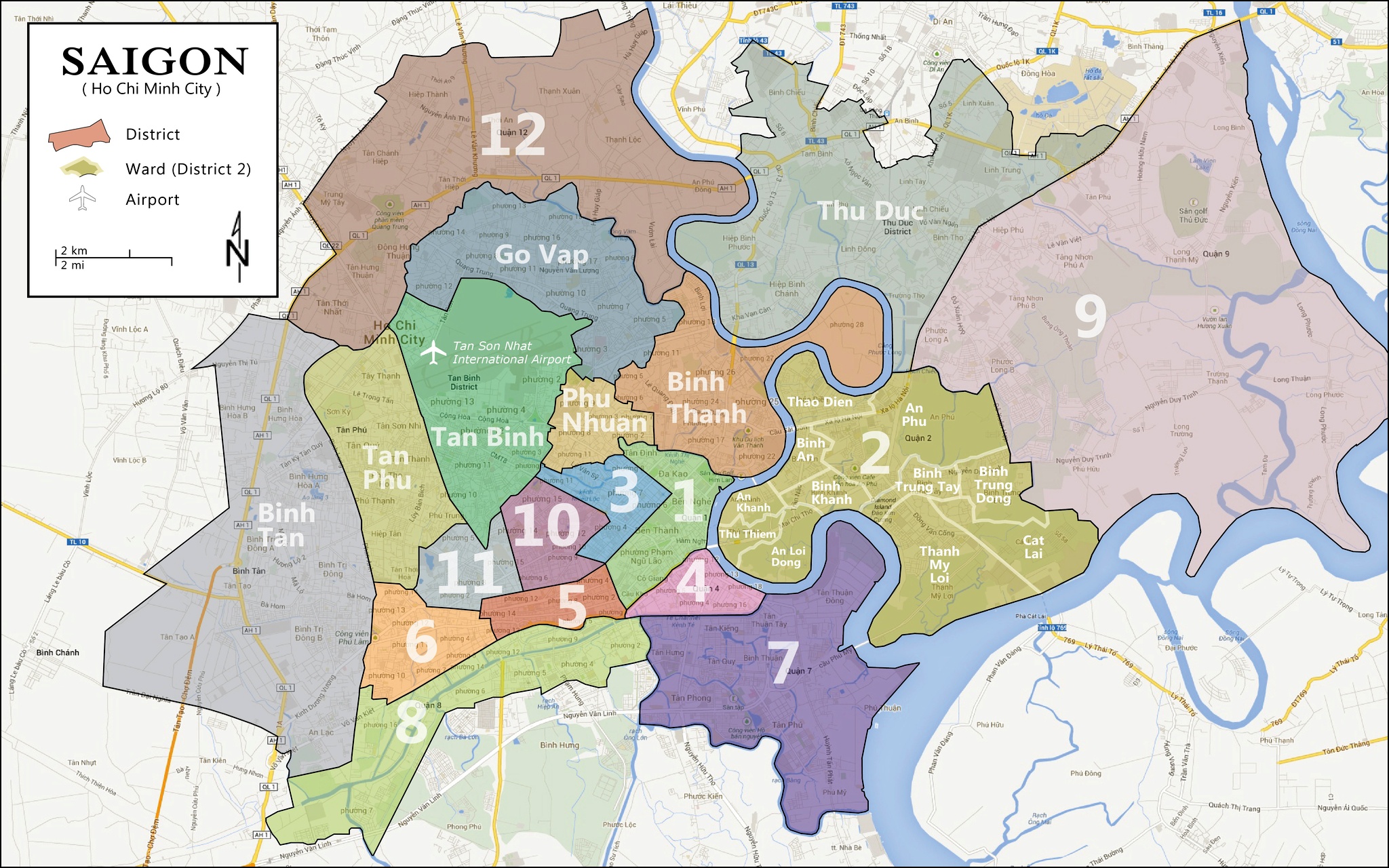

HCMC is separated into many districts as indicated on the map below. I also included a satellite view of HCMC taken by astronaut Scott Kelly.

District 1, D1 is best thought of as the intersection of main-street and main-street. As HCMC’s central business district and the most densely populated area, life here reminds me of Puxi, Shanghai. Recently, a Hong Kong based company called Alpha King bought up 30% of the land in D1, resulting in a doubling of property values in the last three years.

D2 and D7 are both popular with foreigners because of their strong international schools as well as a less dense environment. A significant component of D2 known as the Thu Thiem peninsula remains undeveloped. Nonetheless, Chinese buyers and developers are excited for the day when Thu Thiem get’s the green light from the government and they can try to create another Pudong. The chart below describes the long term plan for Thu Thiem.

Proposed developments in D2 Thu Thiem.

D7 has much unoccupied land and is being developed by a Taiwanese company. One project on the market in D7 is called Eco-Green Saigon, it has 4,000 apartments and 6 total buildings. I attached the marketing materials for Eco-Green Saigon here.

D4 is an older district popular with many local people but with aging real estate and limited land supply for further development, however the location is considered excellent due to close proximity to D1’s CBD.

D9 is HCMC's high tech zone and is the direct recipient of much of the technology and manufacturing FDI going into Vietnam. Today, companies like Intel, Samsung, Schneider all have large manufacturing, design and engineering offices there. Vinhomes/Vingroup is building the largest residential real estate development in all of Vietnam in this area. The massive project called “VinCity” will have 44,000 units and 71 total buildings. I attached the VinCity marketing materials here and the master plan is below.

Red dots represent apartment buildings

During my conversation with Sarah, I asked her to sketch out the current prices and yields in each district. She described the following prices below. Property prices in Vietnam are significantly cheaper than China’s first and second tier cities, and likely explains the strong Chinese demand. Very high yields relative to what is available in their home countries likely explains demand from Japanese and Korean buyers.

3/1/2019

Deal or no Deal?

Suppose one wanted to buy a 75 SQM apartment in VinCity and act as a land lord for the next 35 years, under what conditions might this proposition result in an attractive investment? I constructed a basic financial model to help frame the problem. I estimated a probability weighted, unlevered, IRR of 7.8% and MOIC of 6.4x. Note that there are no capital gains taxes in Vietnam.

Supply and Demand Elasticity

D1’s housing supply will likely remain inelastic. Because Vietnamese own their property and land freehold, large scale redevelopment in D1 is susceptible to hold out problems. In contrast, supply elasticity should be much higher in D2, D7 and D9 given the large quantity of undeveloped land. As such, I reckon one should be relatively more cautious about owning property in these areas.

In summary, Vietnam has improved dramatically in the last eight years. People are getting richer, moving to the cities and buying homes. I am optimistic that Vietnam will be able to learn from China, Korea, Taiwan, Singapore and Japan’s development experience, resulting in continued growth.

My friend translated this article into Chinese, click here for the Chinese translation.