Public Housing Garden's in Xi'an, China

My Chinese teacher, Minna Zhang, lives in Xi’an China. Xi’an is the capital city of Shaanxi Province in Central China with a population of about 12 million people. Minna grew up in a rural area (农村) about 4-5 hours from Xi’an. She is the first person in her family to graduate from college (Shaanxi Normal University in 2016).

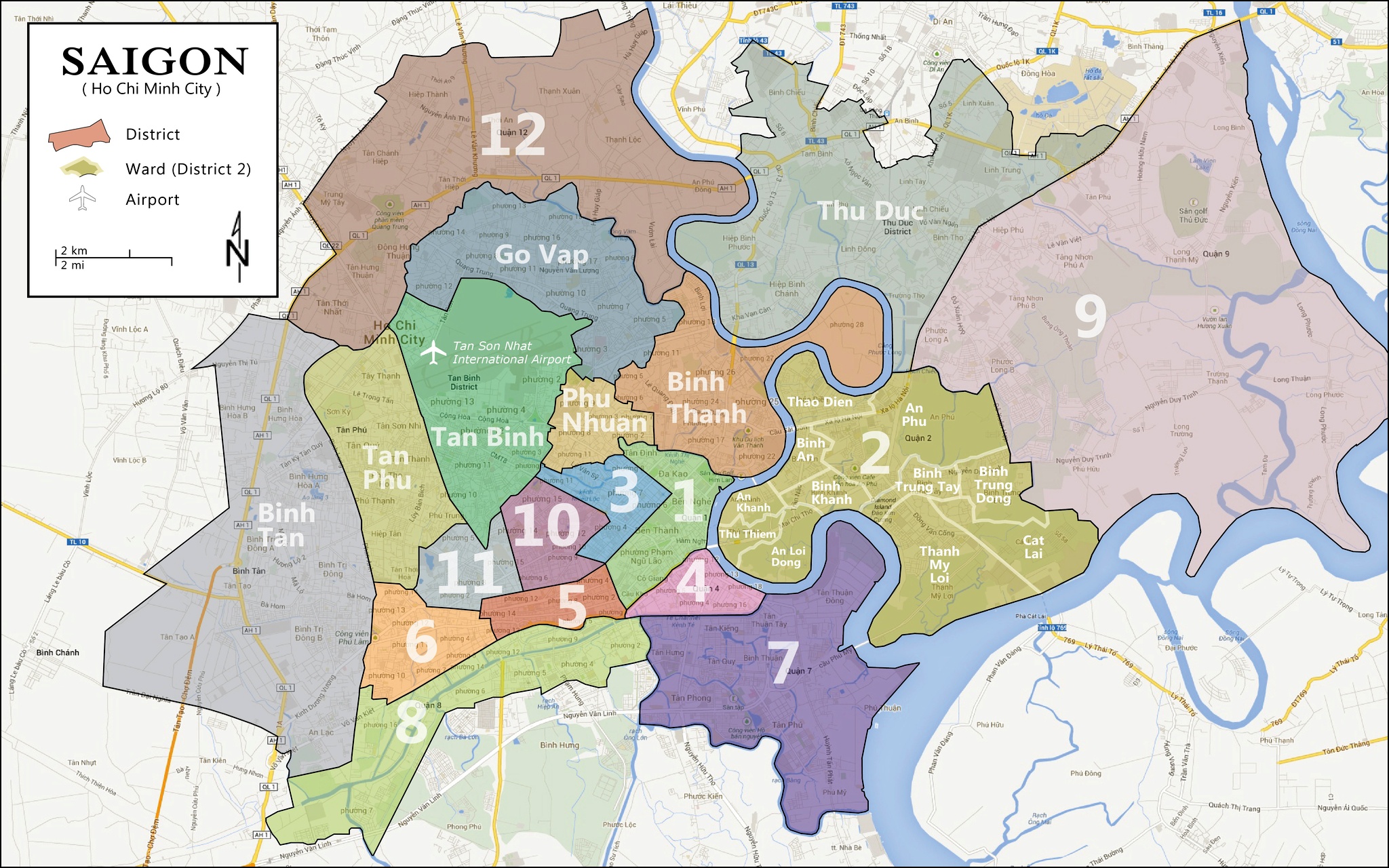

Map of Xi’an with subway lines (colors)

Upon graduating, Minna was worried about where she would live next. Typically, fresh graduates make about 4,000 RMB per month in the Xi’an area and rents in the city center can easily come to more than 2,000 RMB per month.

In the past, fresh graduates would often choose to live in partitioned houses (合租房) these homes are typically converted 1 bedroom or 2-bedroom apartments with shared bathrooms and shared kitchens for multiple units. The rents for these homes are lower than the traditional housing market, but the living conditions can be challenging.

Fortunately, Minna had the opportunity to participate in a new type of public housing program in Xi’an. Starting in 2015, Xi’an began building public housing (公租房) targeting recent college graduates. The purpose of this program is to attract and retain university students in the Xi’an area. Minna’s apartment is a comfortable 43 m^2; 1 bed, 1 bath, kitchen, and living room. Her rent is 300 RMB per month and has not increased. Her public housing garden (公租房小区) contains 25 buildings, each with 33 floors and about 25 units per floor (about 20,000 units). Within the garden itself, they have public meeting areas and even a kindergarten, though it is mostly empty as most of the residents have yet to have kids.

Her public housing garden’s culture is warm and inviting. Everyone in the garden is 22 to 26 years old. Residents join WeChat groups for various interests ranging from singing, sports, studying, and group activities and trips. Having so many young people around makes dating much easier and the party scene is strong.

The biggest drawback to living in her public housing garden is its location. The garden is about a 1-hour drive from the city center. Today, no subway line reaches their area; however, a subway connection should be completed within the next 3-4 years. She was initially worried that the public housing garden would under-spend on maintenance, however she was pleasantly surprised. The government contracted out maintenance (物业) to a third-party service that’s provided her with prompt repairs.

It remains to be seen whether the Xi’an government will allow her to purchase her home. There are rumors that the government will allow residents to purchase their homes, but no firm indication as of Dec 2019.

Overall, Minna believes the public housing garden positives vastly outweigh the negatives. She expects and is excited to continue living in public housing for many years to come.